I?d like to thank Lizzie Hingley who has co-authored this piece, using her 5 year experience of working for Blockbusters for insight

Worldwide Internet Gaming Console Market Update

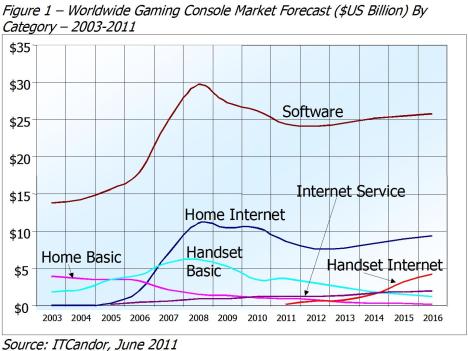

- The total gaming market has declined from its peak at $49 billion in 2008 to $43 billion in 2010

- The entire market is defined by three vendors ? Microsoft, Nintendo and Sony

- The overall market is dominated by software sales which accounted for 62% of spending in 2010

- The Internet console market, until recently exclusive tied to home platforms, accounted for $10 billion and 44 million shipments in 2010

- Internet handsets have been introduced by both Nintendo and Sony ? creating an important new category

- By 2016 the installed base of Internet consoles will reach 238 million ? up from the 142 million at the end of Q1 2011

- Gaming consoles point towards a less general-purpose Internet, with closed communities interacting for narrower purposes

- Gaming console designs pre-date the current fad for IT appliances

- IT departments should think about how younger console users will one day change the way corporate applications should be built and delivered

Gaming Consoles In The News This Week

Gaming consoles are much in the news this week. Nintendo has shown its upcoming Wii U ? complete with its own screen, while Sony has been showing its PSP replacement, complete with communications and joining the Nintendo 3DS as the first Internet gaming handsets.

As Sony has also recently put its Playstation Store back on line following the successful hacker attack in April, we thought it was about time we looked at gaming consoles as part of the computer client universe, so we done some deep research into numbers, building on the ITCandor Market Model and present our review and forecast here.

We?ve looked at the shipments and revenues from all gaming consoles, both home and handheld from 2003, capturing software and Internet Service revenues along with hardware. Our focus is on those machines which are connected in real time to the Internet, which includes Sony?s Playstation, Microsoft?s Xbox 360 and Nintendo?s Wii ? so most of what follows concerns those. We do not cover PC gaming machines in this paper, although we recognise this as an important and large extra component of the gaming market.

Gaming consoles are turnkey devices tuned for high quality graphics and processing to deliver fast and true-to-life visualisation of computer games. They are important for the IT industry in a number of ways. For instance:

- Hardware suppliers can win major, long-life contracts to supply components: IBM, for instance, provides versions of its PowerPC RISC chip to all three platforms, while AMD?s graphics are used in the Wii and xBox

- It can held vendors break markets ? Sony?s use of its own Blue-ray disks in the Playstation 3 helped the format win in the battle for overall adoption against HD DVD

- Through Internet connections they provide access to app stores and interactive gaming; this is a restricted, but important experience for millions of young users

- In a sense the gaming console market is more like the PC than the Smart Phone, especially in its concentration on its own processing and applications stored locally

As always we have far more market data and forecast information available for those of you who need more for your market planning, especially on model and country levels ? so please contact us.

The Gaming Market IS Dominated By Software Sales

The advantage of selling tens of millions of consoles with identical specifications is that it creates ready-made platforms for games producers. The console manufacturers themselves join with companies such as Activision Blizzard, Electronic Arts, Rockstar Games and Epic in creating a massive software market ? albeit with each package having to be tuned for each platform. Of the various components of the gaming console market software is undoubtedly the largest part (see Figure 1), with is $26 billion revenue accounting for 62% of the whole market in 2010.

As a consumer area the gaming market was very resistant to the downturn of 2008 ? in fact we believe that the decline in value in 2009 and 2010 was largely due to competitive products (not least the upsurge in Smart Phone sales). Apple?s iPad and Android Smart Tablets in particular have sold their gadgets to consumers who in

previous years would have bought consoles, In addition it is clear that we?re nearing the end of life for the current three home platforms ? they were introduced between Q4 2005 and Q4 2006. While the technology package of the PC moves in small incremental steps, the gaming console market relies on their specifications remaining the same for a long period of time. Vendors develop add-ons, such as Microsoft?s Kinect wireless motion controller, which finally adds a similar functionality to the Wii, which had wireless controllers from the outset. However the financial success of such products is an exception rather than a rule in this market.

Home Consoles outsell Handsets in this market and have definitely been aided by the addition of Internet connections. In 2010 the three platforms accounted for $10 billion, which was 22% of the total market. Handsets have only recently added Internet connectivity. Our forecast suggests that this new category will

account for $4 billion and 10% of the total market in 2016, although we are weary of forecasting a market in its infancy. As in the home console market we

expect the new form factor to take over slowly from the basic handsets currently on sale.

Nintendo Leads In The Internet Home Console Market

In the year to the end of Q1 2011 Nintendo?s Wii accounted for 37.8% of the value of Internet home console sales (see Figure 2). Its share has declined significantly over the year, losing to Sony Playstation and ? more dramatically Microsoft?s xBox. The total value of hardware business remained static at $10.3 billion.

The comparative shares of the three vendors changes significantly based on the perceived advantages of features and the availability of the latest software titles. The importance of software is underlined by the fact that these vendors identify the number of and names of these products in their quarterly financial results.

The high cost of developing new platforms prevents other companies from participating in this market, as does the long time it takes to make a profit: Sony was recently accused of selling its console at less than cost price in order to establish Blue ray. If so, it?s not so unlike Smart Phone suppliers, whose products can be

substantially discounted by their prices being hidden in Telecom suppliers? contracts.

It is possible, but unlikely, that horizontal players could open up the market to others, as AMD, Google and Microsoft have done in the Smart Phone market, not least because in that market Apple has forced a massive step towards proprietary design. For now the console designs remain closed and highly proprietary, with even the

processing and graphics chips customised for each machine.

As a consumer toy, the gaming market is highly seasonal, with the fourth quarter before Christmas representing a significant peak. Figure 3 shows the quarterly sales of all three platforms. Overall 46% of the value of hardware in 2010 shipped in Q4, which matches the demand from Western countries. The second strongest quarter was Q1, when 22% of the value was shipped ? at least partially influence by demand from Japan and Asia.

Some Conclusions ? Internet Console Use And Generation Z Will Change IT

The average age of gaming console users is undoubtedly lower than that of Smart Pones or PCs and it?s important that they are arguably better platforms than PCs in allowing parents to prevent their children from viewing adult material. Gaming consoles can produce very rich connected experiences and naturally lead to the development of large communities associated with the biggest games: Call of Duty on xBox for instance allows interactive players to talk to each other via headphones wherever they are in that environment. Perhaps we also get a glimpse of the future of the general Internet in communities such as Grand Theft Auto, which some claim has become a virtual desert.

We should think about how gaming will affect the IT market in 10 years time ? how Generation Z will bring about even more changes than Generation Y are currently. Our research suggests a set of more closed virtual worlds, communities being more directly connected for a narrow set of activities, an increase in social CRM, access via new devices such as motion controllers and the growth of monitored involuntary data. The ability to exist in a virtual world will also lead to virtualisation shifting into new directions in future beyond the hardware and infrastructure issues of today.

The numbers show that the gaming console market is threatened by the current trend in spending on Smart Tablets, their static functionality and the high cost of developing new platforms. However we see them having an increasing role to play in the development of the Internet ? especially now the handsets are getting connected. Who knows ? perhaps we should prepare ourselves for new employees demanding access to corporate applications from Wiis, Playstations and Xboxs.

If you are a gamer with observations about the differences in Internet experiences between consoles and PCs, please let us know by commenting on this post.

Filed under: Corporate Desktop Futures Tagged: | #Activision Blizzard, #Electrong Arts, gaming console, gaming handset, Generation Y, Generation Z, Nintendo, Sony

Source: http://martinhingley.wordpress.com/2011/06/09/gaming-console-forecast-q211/

piper perabo uni anna hazare duke nukem forever review neil armstrong adam levine christina aguilera

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.